Proven Experience

Close to 2 decades of hands-on investment experience, managing residential investment property, and sales in the Rochester market.

Own Rochester real estate — Skip The tenants & toilets.

Professional local management.

Minimum investments starting at $500.

You want to grow your wealth through real estate — but doing it alone usually means stress, risk, and responsibility.

What’s supposed to create freedom often turns into another full-time job — and when things go wrong, the risk and liability fall entirely on you.

“It’s only when the tide goes out that you learn who’s been swimming naked.”

That’s why we believe real estate works best when there’s a clear system, defined protections, and you’re not left to figure it out alone.

You’ve worked hard, bought rentals, and chased “passive income”—but endless calls, unreliable tenants, and hidden headaches have made it feel like another job. What you want now is truly passive wealth, real alignment, and a guide you can finally trust.

Join a community of Rochester investors who own rental properties together.

An experienced team manages the properties, while you share in the ownership.

Join a community of investors backing Rochester housing through disciplined acquisitions and long-term fundamentals — not speculation.

Residential Rentals

92%–95%

10% of Capital Raised

5 Years

Rochester, New York Metropolitan Area

$1,235,000

$500

Rochester, New York

Single Company

$75,000–$90,000 per unit

50 Units

| Preferred Return | 6% |

| Target IRR | 14.8% |

| Target Equity Multiple | 1.77× |

| Distribution Frequency | Monthly |

| Waterfall | 6% Preferred Return → 100% Return of Capital → 70% / 30% |

| First Distribution | The Month Following Investment |

Rochester is one of the best places in the country to build long-term wealth through real estate. The fundamentals are here: stable demand, accessible prices, and a market that rewards patience over speculation.

Rather than chasing overheated or speculative markets, we focus on properties priced for cash flow, neighborhoods with durable demand, and a local approach grounded in discipline over hype.

This market-first approach allows investors to participate in real estate with clearer expectations and fewer unknowns.

Accessible Pricing

Rochester real estate remains more affordable than many U.S. markets, allowing capital to be deployed efficiently.

Consistent Rental Demand

A strong employment base in healthcare, education, and regional industries supports long-term housing demand.

Local Market Advantage

Investing close to home allows for better oversight, stronger relationships, and informed decision-making.

Jason Johansen

Licensed Real Estate Broker

Living585 Realty

After Army deployments, fire-damaged properties, and the hard road from solo operator to system-builder, I’ve survived what most only read about. My investors choose me because I don’t oversell, I don’t hide the hard parts, and I only win when you do.

(GP revenue is earned only after you’ve received your preferred return plus full capital back.)

I oversee property acquisitions, financing, and ongoing portfolio management — so investors don’t have to spend their life stressing out about tenants, toilets, and mortgage payments.

With nearly two decades of experience in the Rochester market, I brings disciplined, and a local-first approach to building and managing income-producing residential portfolios.

Close to 2 decades of hands-on investment experience, managing residential investment property, and sales in the Rochester market.

A trusted network of local professionals oversees operations, renovations, and maintenance.

Experience acquiring, operating, and selling investment properties with a disciplined approach.

The manager invests alongside the company and is aligned with long-term portfolio performance.

The Manager’s duties are outlined in the operating agreement and offering materials.

Straightforward answers to help you understand how investing through Invest in the ROC works.

Investments are available to both accredited and non-accredited investors, subject to Regulation Crowdfunding (Reg CF) eligibility limits.

Investment opportunity starts at a $500 minimum.

Preferred return payments are set up to begin the month after an investment is made and continue monthly, as outlined in the offering documents.

No. Real estate investments involve risk, and returns are not guaranteed. Investors should review all offering materials carefully before investing.

Investors invest into a single company. That company uses investor funds to acquire and manage multiple properties. The specific structure, including how properties are held, is explained in the offering documents and operating agreement.

Properties are professionally managed by local operators. Investors are not responsible for day-to-day property management.

Investors receive updates and communications through the online investor portal for each offering.

These investments are not meant to be sold quickly. Investors must hold their investment for at least one year, and any sale or repayment request is subject to the terms described in the offering materials.

All investments involve risk. Please review the official offering documents before investing.

Explore active offerings and review how the investment is structured.

Participation takes place through a registered crowdfunding portal.

Local operators manage the properties. No Work.

Ongoing performance updates and reporting through the investor portal.

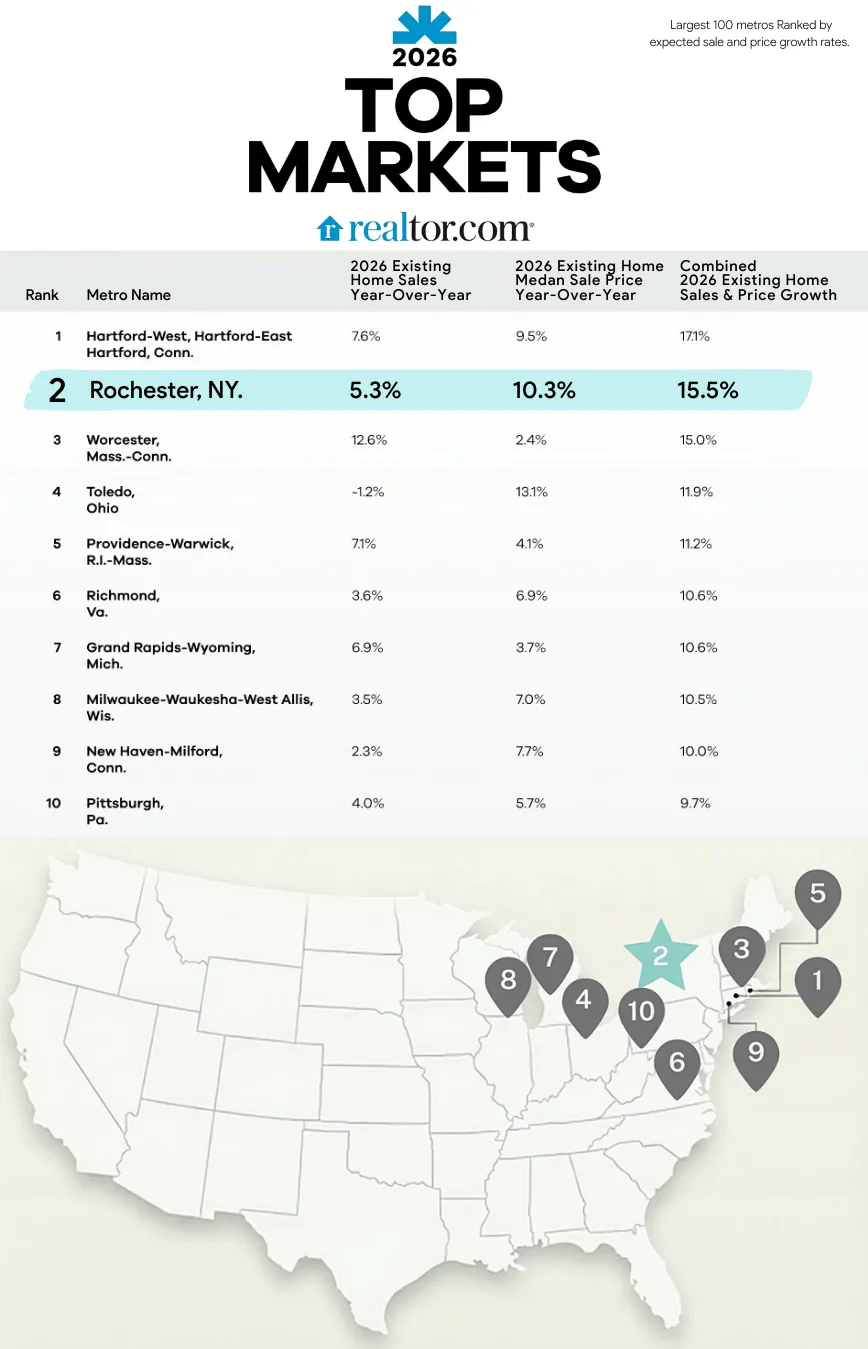

While the national housing market is expected to stabilize in 2026, Rochester is projected to outperform based on affordability, supply constraints, and steady demand.

15.5% combined growth, placing Rochester just behind Hartford and ahead of markets like Worcester, Providence, and Richmond

A median list price of ~$257,000, well below the national median of ~$415,000

Rochester’s 1.1M+ metro population supports consistent, long-term housing demand.

Why Rochester Is Drawing Attention

Rochester’s 2026 outlook—affordable, tight supply, value-driven market, built on durable fundamentals, and limited exposure to speculative cycles.

Strong demand without runaway pricing

Limited supply supporting durable appreciation

Buyers with solid credit and meaningful equity

A local economy anchored by healthcare, education, and established industries

“Someone’s sitting in the shade today because someone planted a tree a long time ago.” — Warren Buffet

without tenants & toilets.

by a local team.

starting at $500.

© Copyright 2026 Meridian Growth Collective LLC - All rights reserved